On June 5, at a conference in Miami, El Salvador President Nayib Bukele announced that the Central American country is in the process of adopting bitcoin as legal tender: a move that would make El Salvador the first country to deem bitcoin an official national currency. Despite El Salvador’s small size, Bukele’s effort is a major milestone in monetary policy history, one with significant ramifications for the global financial system.

‘Potentially helping billions around the world’

At the Bitcoin 2021 conference, Bukele described his legislative proposal as a way to “design a country for the future.” On Twitter, he pointed out that if 1 percent of the world’s bitcoin moved to El Salvador, it would amount to a quarter of the country’s annual economic output.

And Bukele is not engaging in wishful thinking. Each year, Salvadoran emigrants send $6 billion home in remittances, from places like the United States. Indeed, 2.2 million people of Salvadoran ancestry live in the U.S., compared with 6.5 million in El Salvador itself. Today, Salvadoran emigrés’ remittances must travel back through middlemen who take cuts as large as 20 percent. “By using bitcoin,” tweeted Bukele, “the amount received by more than a million low income families will increase in the equivalent of billions of dollars every year.”

70 percent of Salvadorans lack bank accounts, Bukele noted. Because people can transmit bitcoin to relatives and businesses on their smartphones, without the need for a bank account, the move to make Bitcoin legal tender could help achieve the “moral imperative” of financial inclusion, and provide “a space where some of the leading innovators can reimagine the future of finance, potentially helping billions around the world.”

The political party Bukele founded, Nuevas Ideas, controls 56 seats out of 84 in El Salvador’s legislative assembly, the Asamblea Legislativa, making it likely that Bukele’s bitcoin initiative is enacted into law.

El Salvador’s interest in adopting bitcoin as legal tender has other powerful economic rationales.

In 2001, after a long period of instability, El Salvador replaced the Salvadoran colón with the U.S. dollar. Indeed, dozens of countries either peg their currencies to the value of the U.S. dollar or use the greenback outright, especially those with heavy trade or tourism relationships with the U.S., such as the nations of the Caribbean Sea, and oil exporters like Saudi Arabia and Qatar.

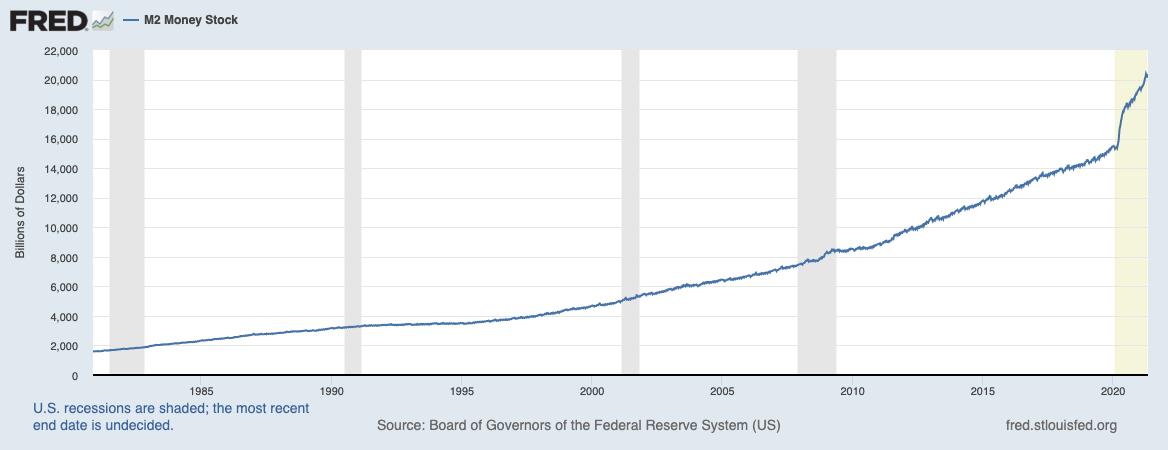

Overall, this system has worked fine for El Salvador, but recently things have taken a turn for the worse. In an effort to blunt the economic effects of the coronavirus pandemic, the U.S. Federal Reserve has dramatically expanded the supply of circulating U.S. dollars, as measured by the M2 money stock, from $15.35 trillion in February 2020 to $20.26 trillion in May 2021. That’s an increase of 32 percent, unprecedented in modern peacetime U.S. history.

From February 2020 to May 2021, the U.S. Federal Reserve has increased the circulating supply of U.S. dollars by a proportion unprecedented in peacetime history.

FEDERAL RESERVE BANK OF ST. LOUISWhile the Fed’s extraordinary measures succeeded in pumping more cash into the coffers of U.S. financial institutions, the stock market, and other aspects of the U.S. economy, the same was not true for Salvadorans, whose banks did not receive infusions from the Fed, but did lose purchasing power due to U.S. monetary inflation.

Indeed, Bukele’s proposal states that “central banks [like the U.S. Federal Reserve] are increasingly taking actions that may cause harm to the economic stability of El Salvador…in order to mitigate the negative impact of central banks, it becomes necessary to authorize the circulation of a digital currency with a supply that cannot be controlled by any central bank and is only altered in accord with objective and calculable criteria.” The supply of bitcoin is capped at 21 million units, making the digital currency immune to the types of policy changes that affect the U.S. dollar and other “fiat” currencies.

Bitcoin thought leaders are working with the Salvadoran government

The Salvadoran marriage to Bitcoin has been two years in the making. Bitcoin entrepreneur Jack Mallers, who helped build the Lightning Network to facilitate fast, low-cost bitcoin transactions, has been working with Bukele and other Salvadorans to make bitcoin a feasible means of exchange for everyday purchases.

Another crypto entrepreneur, Adam Back of Blockstream, told CNBC that he “plans to contribute technologies like Liquid,” which like Lightning can speed up bitcoin transactions, “and satellite infrastructure to make El Salvador a model for the world.” Satellites can help rural Salvadorans connect to the internet, and thereby to the Bitcoin network, in places where land-based connectivity is poor.

Mallers has been working to increase Salvadoran adoption of his smartphone app Strike, a Lightning-powered analog to Venmo or Cash App. In 2019, thanks to a anonymous donation, crypto entrepreneurs founded Bitcoin Beach, as a way to pilot in El Salvador a circular Bitcoin economy in which residents and businesses transact entirely in bitcoin, without conversions to and from U.S. dollars.

In a press release, Strike stated “making bitcoin legal tender is a leapfrog moment that can help countries like El Salvador shift from a largely cash economy to an innovative, inclusive, and transparent digital economy where your bank account is your phone.” Mallers described the Salvadoran move as the “shot heard ’round the world” because it would provide “a way to protect developing economies from potential shocks of fiat currency inflation.”

Could El Salvador become the world capital of the Bitcoin ecosystem?

Alongside the potential for Salvadoran emigrants to send remittances back to their home country, the move by El Salvador to make bitcoin legal tender could also attract western and Asian crypto entrepreneurs. “Crypto investors and entrepreneurs will start to move to El Salvador!” tweeted Justin Sun, founder of cryptocurrency platform TRON. “Amazing! Packing now!”

Changpeng Zhao, founder of Binance, the world’s largest cryptocurrency exchange, tweeted a GIF of Mickey Mouse hurriedly tossing clothes into a suitcase, implicitly heading to El Salvador.

In 2019, according to the World Bank, El Salvador ranked 115th out of 186 countries in annual gross domestic product per capita on a purchasing power parity-adjusted basis, with $9,164. A handful of crypto billionaires moving to El Salvador could transform the country.

Ireland was once one of the poorest countries in Europe; beginning in 1996, Ireland reduced its corporate tax rate from 40% to 12.5%, resulting in a multi-decadal economic boom as large multinationals relocated to the Emerald Isle. In 2019, Ireland’s PPP-adjusted GDP climbed to 4th in the world at $89,684, ahead of the 8th-ranked U.S. ($65,298) and even 5th-ranked Switzerland ($72,376).

El Salvador has more to do to replicate Ireland’s success. The Heritage Foundation ranked the country 94th out of 184 countries in its 2021 Index of Economic Freedom, dinging El Salvador’s “uneven” protection of property rights and inconsistent rule of law, noting that “three of the past four presidents have been indicted for corruption.”

Earlier this year, President Bukele’s allies in the Asamblea Legislativa voted to replace the five members of El Salvador’s highest court, the Constitutional Court, and also the country’s attorney general. Mary Anastasia O’Grady, Americas columnist at the Wall Street Journal, responded by expressing concern that “under Mr. Bukele El Salvador may be the next Latin domino to fall to authoritarianism.” The U.S. Agency for International Development, USAID, led by Samantha Powers, redirected funding from the Salvadoran government to civil society groups.

In other words, if El Salvador is to become a global crypto capital, entrepreneurs who move there will need to help increase confidence in the country’s legal and economic institutions.

If El Salvador doesn’t improve quickly, it could face competition. Other countries may follow El Salvador’s lead in adopting bitcoin as legal tender. Most Caribbean nations peg their currencies to the U.S. dollar, for example, and many, like the Cayman Islands, are already well-versed in attracting foreign capital through low tax rates and efficient financial regulation.

Significant implications for U.S. companies and individuals

El Salvador’s bitcoin policies will also have significant ramifications for individuals and businesses in the United States and elsewhere.

Today, in the U.S., it’s difficult to use bitcoin for ordinary payments, like buying a cup of coffee. That’s because, in 2014, the Internal Revenue Service defined cryptocurrencies as “property for Federal income tax purposes.” As a result, if you use bitcoin at Starbucks, and you purchased that bitcoin a few years ago when its price was lower, under IRS rules you’ve triggered a taxable event for which you have to report capital gains and fill out a cumbersome form.

This IRS-imposed friction makes it extremely difficult to use bitcoin for everyday payments in a legally compliant way. On the other hand, if bitcoin is legal tender in the same way that euros and British pounds are, it becomes much easier to use bitcoin for ordinary payments, because the IRS thinks differently about transactions using foreign currencies.

Something similar affects large U.S. corporations and financial institutions that wish to hold bitcoin on their balance sheets. U.S. generally accepted accounting principles, or GAAP, and their parallels abroad long predate the invention of Bitcoin. Today, GAAP regards virtual currencies like bitcoin as “indefinite-lived intangible assets.” In real-world terms, this means that if a company bought one bitcoin at $50,000, and the market price goes down to $35,000, the company must write down the $15,000 loss as an “impairment.” By contrast, if the price of bitcoin goes up to $60,000, the $10,000 appreciation cannot be logged as an unrealized gain. These GAAP accounting quirks basically mean that, from a cosmetic standpoint, owning bitcoin on corporate balance sheets is nothing but downside, even if in reality the value of a company’s bitcoin holdings appreciates substantially.

The transformation by El Salvador of bitcoin into legal tender, i.e, a foreign currency, makes the accounting treatment much more straightforward, enabling every corporation in America to hold bitcoin in the same way that it holds other forms of cash. Such a change could dramatically increase the utility of bitcoin for corporate treasury management.

Most importantly, El Salvador’s decision has ramifications for one of the greatest sources of skepticism for Bitcoin’s staying power: the theory that the U.S. will ban the digital currency if it ever becomes a true competitor to the U.S. dollar. “Bitcoin’s greatest risk is its success,” said Ray Dalio, founder of the world’s largest hedge fund, Bridgewater Associates, at the Consensus cryptocurrency conference in May. But banning the official national currency of another country would be an unprecedented step for the U.S., one that could, on its own, undermine the greenback’s utility as the world’s premier fiat currency.

El Salvador may be the smallest country in North America. But if President Bukele’s bitcoin proposal becomes law, El Salvador could become one of the most significant monetary centers in the world.

Original article: https://www.forbes.com/sites/theapothecary/2021/06/07/el-salvador-to-make-bitcoin-legal-tender-a-milestone-in-monetary-history/?sh=20d4d3f975b9

Leave a comment